Transferring real estate to an LLC is a prudent strategy mainly because an LLC (1) protects the LLC’s assets from the creditors of its members (i.e., owners) and (2) shields the LLC’s members from liabilities associated with real estate ownership, such as injuries or deaths occurring on the property.

Changing a Texas LLC to a PLLC

Learn about the differences between an LLC and a PLLC, the reasons why you would be required to use a PLLC, and how to convert from one to the other.

EIN Guide for Texas LLC Owners

This comprehensive EIN guide will demystify the EIN concept as it relates to Texas LLCs and provide you with a clear understanding of why, when, and how to obtain an EIN for your Texas LLC.

Does each series need a separate bank account?

In this article, we outline when a series should have a separate bank account and discuss the best and worst banks to open a series account.

Does each series need a separate EIN?

In this article, we outline when a series of a Series LLC would need or want its own EIN (i.e., federal tax identification number).

Selecting a Registered Agent

This article will demystify the registered agent concept, outline the legal requirements, and give you clarity on who should be the registered agent for your business.

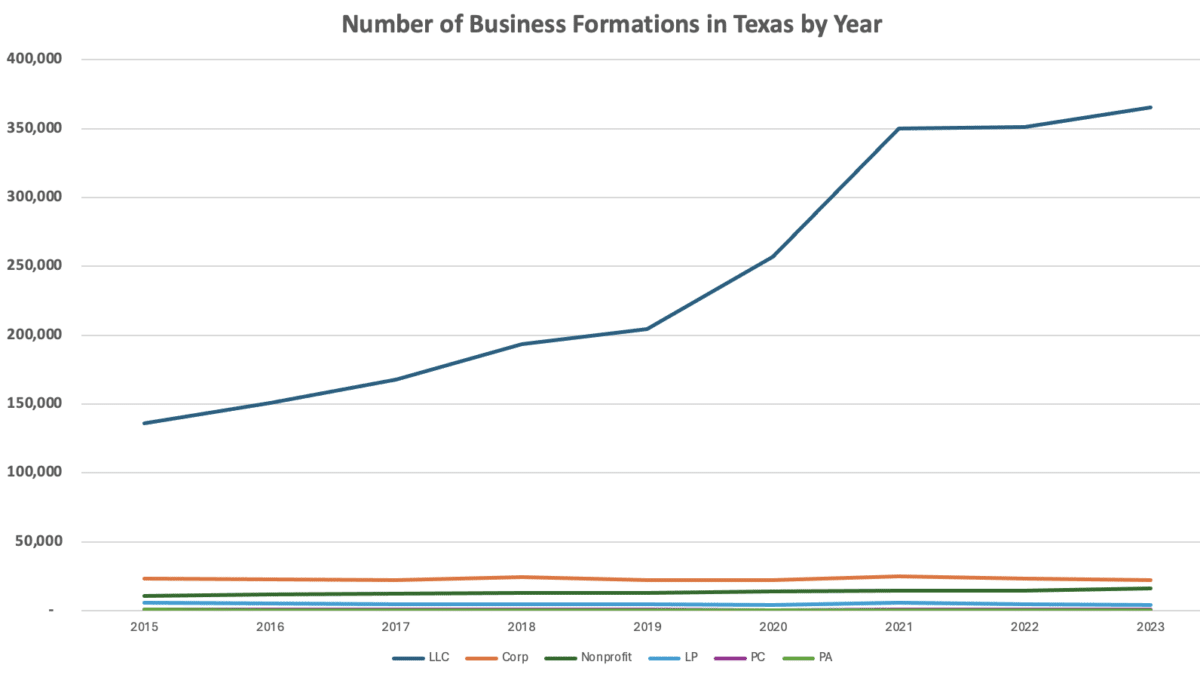

Texas LLC Statistics

LLCs have emerged as a top choice for entrepreneurs, but how popular are they really? This article will reveal the latest LLC formation statistics, uncovering surprising trends and insights.

Corporate Transparency Act Reporting

The reporting requirements of the CTA went into effect on January 1, 2024. Every business entity (“Reporting Company”) must report certain information about the business and its owners to the U.S. Treasury’s Financial Crimes Enforcement Network (“FinCEN”). This report is called a beneficial ownership information report (“BOI Report”)

Can a Texas real estate agent use an LLC to receive commissions?

Yes, the Texas Real Estate Commission (TREC) allows real estate agents to use an entity like a limited liability company (LLC) as a business structure. However, there are specific requirements that must be met in order to comply with TREC regulations.

Series LLC for Real Estate

This article will explore the immensely popular Series LLC and highlight why it is ideally suited for real estate investors.

Series LLC vs LLC

The key difference between a Series LLC and an LLC is the Series LLC’s ability to utilize “series” and thus segregate and insulate assets (or businesses) within the framework of a single LLC.

Veteran-Owned Business Certifications

In this article, we outline the various veteran-owned business certifications, explore the pathways to achieving them, and delve into the benefits they offer.

Should you hire a lawyer to form a Texas LLC?

Even though it is not mandatory, consulting with an experienced business formation attorney can provide you with peace of mind and ensure that your LLC is formed correctly and meets all legal requirements.

Texas LLC Annual Maintenance

Looking to keep your Texas LLC in good standing with the state? Our comprehensive guide to annual maintenance has got you covered! Learn about the required filings, fees, and other important considerations for maintaining your LLC. Don’t let annual maintenance tasks catch you off guard – read our guide today and stay ahead of the game!

How to locate your Webfile number

In this article, we will explore how to access the Webfile system and what to do if you cannot locate your access code (aka your Webfile number).

Should I include my spouse as an owner of my LLC?

What are the pros and cons to including my spouse as an owner of my new LLC? Since Texas is a community property state, won’t my spouse own 50% of my new LLC anyway?

Texas LLC vs Corporation

The two most popular entity types in Texas are the LLC (limited liability company) and the corporation. In this article, we will compare and contrast the LLC and corporation and outline the main similarities and key differences.

Texas Business Name Rules

Choosing the wrong name can have serious consequences, especially if the name you select already belongs to another business.

LLC for Real Estate

Using a Texas LLC (limited liability company) for holding Texas real estate (other than your primary residence) is important as it provides legal protections for both the real estate and the individual owner(s).

How long does it take to form an LLC in Texas?

Depending on how the formation paperwork is submitted, it can take as little as 4 business days to form an LLC in Texas.

Anonymous LLCs in Texas

The term “anonymous LLC” describes an LLC in which the owner’s identity is not disclosed publicly. The LLC formation paperwork (the Certificate of Formation) and the information contained therein is visible to the public once filed with the state. As such, it is important to know what information is required by the state of formation as each state’s requirements differ. If privacy is important to you, an effective anonymity strategy must be implemented.

Texas LLC Name Availability

There are many resources you’ll need to navigate when performing due diligence on the availability of a Texas LLC name. We’ve listed a handful of our favorite resources that will help you select a name for your new Texas LLC.

Texas LLC Overview

Virtually every entrepreneur or investor has been told they should consider using a business entity like a limited liability company (LLC), but why? What are the benefits? How much will it cost you? What options should be considered?

How To Name a Protected Series in Texas

The naming requirements for a Series LLC are similar to a traditional LLC. In this article, we’ll look at naming strategies and requirements for each series (aka protected series) of a Series LLC.

How to change the name of a Texas LLC

When a business decides to use a new name, there are a handful of tasks that need to be completed. This article will outline a name change task list and provide a name change alternative.

How to update the address of a Texas LLC

As a business owner, changing your business address can be overwhelming. You’ll need to notify multiple parties of the new address. We have put together a task list to help you determine potential parties that may need to be notified of the new address.

Veteran owned LLCs in Texas

When forming a Texas LLC or using a Texas LLC to operate a business, veterans are entitled to some benefits.

How to convert a sole proprietorship to an LLC

When your business is just starting, operating as a sole proprietor often makes sense. But as the business grows, switching from a sole proprietorship to LLC is a wise choice and, thankfully, a simple one to make.

Annual Costs for a Texas LLC

Unlike almost every other state, there are no annual fees to keep an LLC active in Texas. There is an annual report that must be filed with the Texas Comptroller, but there is no filing fee for the annual report. Learn more about the initial costs to form a Texas LLC.

When to register a foreign LLC in Texas

If you have an LLC established outside of Texas and the LLC does business in Texas, you must file an “Application to Register Foreign LLC” (TXSOS Form 304) with the Texas Secretary of State within 90 days of the first business transaction in Texas.

Texas Single Member LLC

The Texas single-member LLC (SMLLC) is the most popular entity choice for businesses with one owner. In this article, we will address frequently asked questions including advantages, disadvantages, costs, taxation, annual maintenance, etc.

What to do after forming a Texas LLC

See a sample post-LLC formation task list.

Benefits of a Professional Registered Agent

Some of the benefits of a professional registered agent are: privacy, consistency, avoiding embarrassment, efficiency, adaptability, compliance, & savings.

Texas Professional LLC (PLLC) Overview

A business entity that is formed for the purpose of providing a “professional service” (i.e. a service that requires a Texas license) may need to be a professional entity like a professional corporation (PC) or professional LLC (PLLC).

How much does it cost to form a Texas LLC?

The cost to form an LLC in Texas equals the state filing fee ($300) plus the service fee if you hire someone to create your Texas LLC.

LLC Taxation

LLCs do not have their own federal income tax classification. As such, the LLC gets to choose between the existing tax classifications: (1) Sole Proprietorship/Partnership; (2) S-Corporation; or (3) C-corporation.